capital gains tax increase in 2021

A Retroactive Capital Gains Tax Increase. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

2019 2021 Capital Gains Tax Rates Go Curry Cracker

Tax Changes and Key Amounts for the 2022 Tax Year.

. Your 2021 Tax Bracket To See Whats Been Adjusted. However it was struck down in March 2022. The Chancellor will announce the next Budget on 3 March 2021.

Currently the top capital gain tax rate is 238 percent for gains realized on. Capital Gains Tax. Many speculate that he will increase the rates of capital.

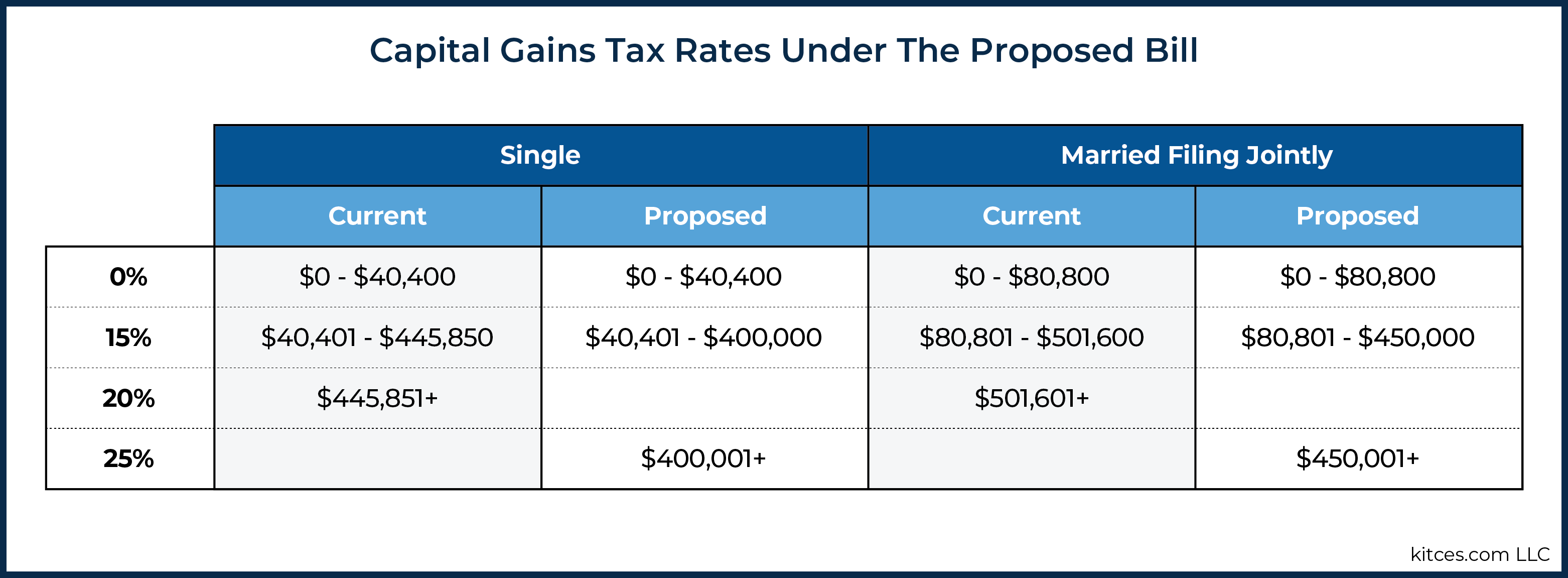

The proposal would increase the maximum stated capital gain rate from 20 to 25. The tax hike would apply to households making more than 1. 2021 capital gains tax calculator.

In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. Bracket creep results in an increase in income taxes without an increase in real income. Filers paid hundreds of billions more in taxes for 2021 and surging capital gains may have been to blame according to an analysis from the Penn Wharton Budget Model.

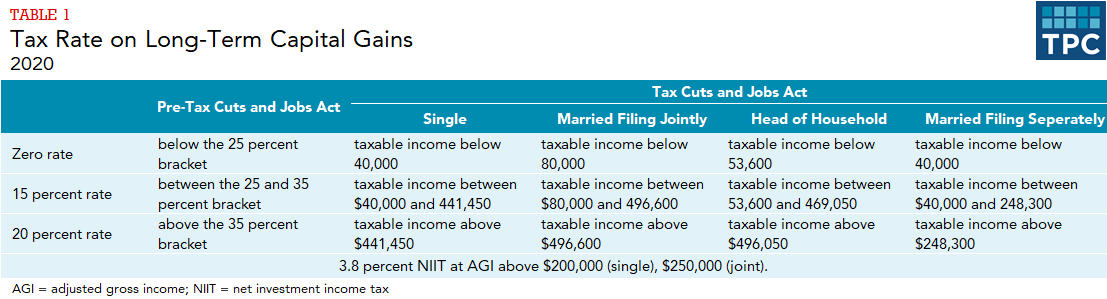

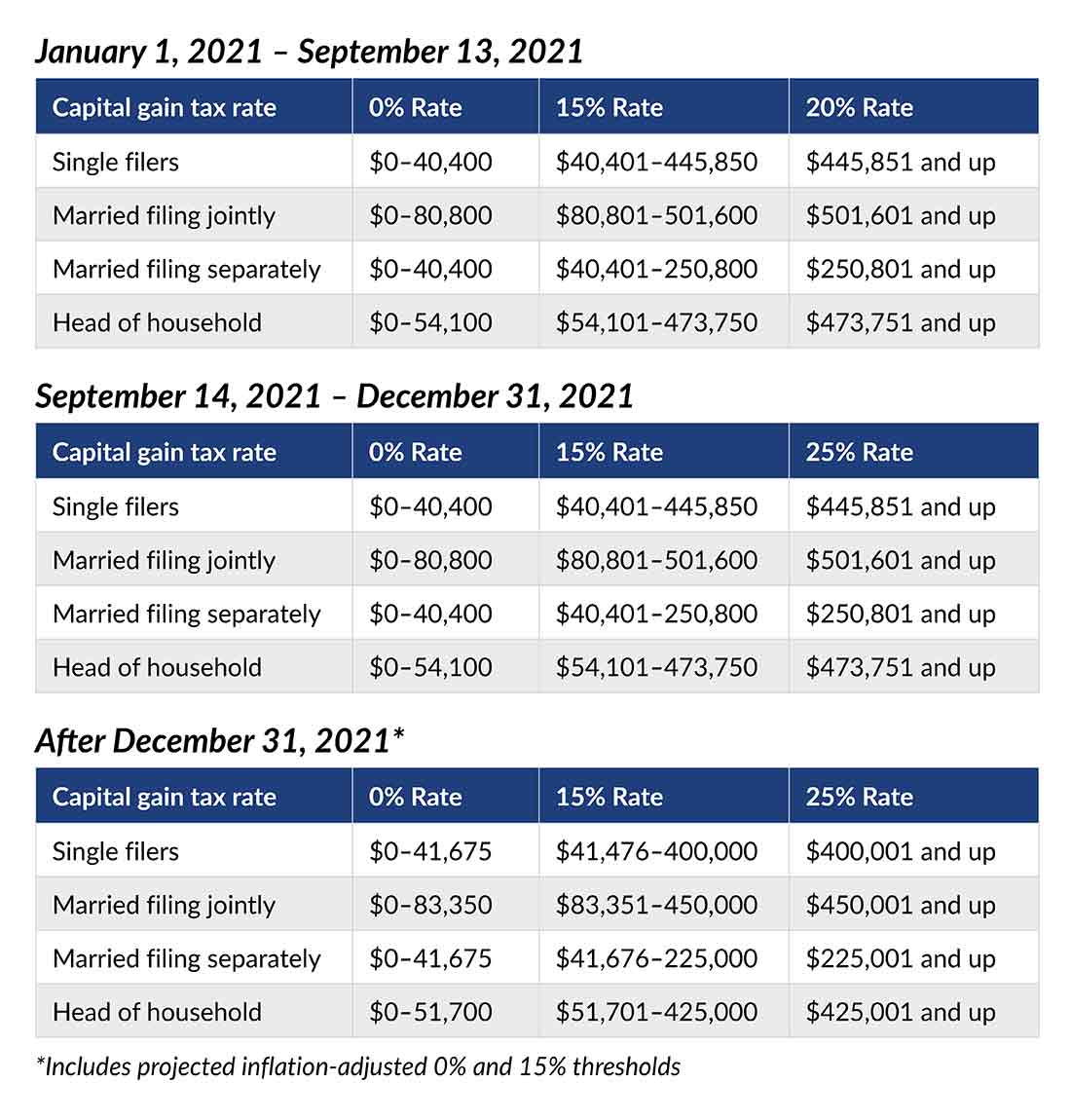

2021 Capital Gains Tax Rates Brackets Long-Term Capital Gains. This included the increase of GT rates so they were more similar to income tax which was a big problem for anyone looking to sell. The effective date for this increase would be September 13 2021.

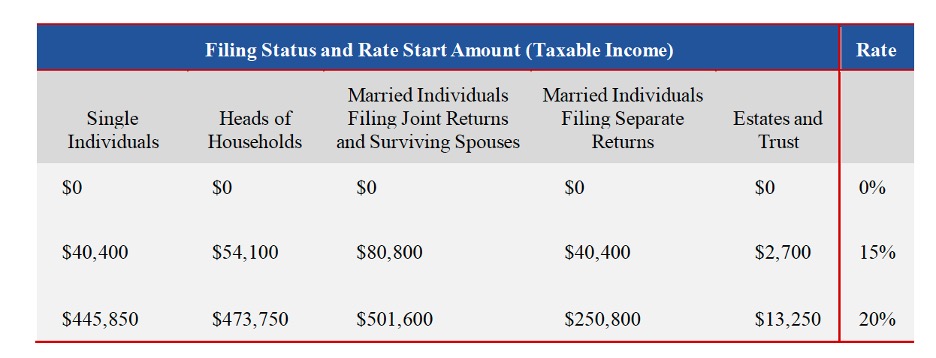

2022 capital gains tax rates. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately.

Capital Gains Tax Rates 2021 To 2022. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. For example if you had 900000 in wages and 200000 in long-term capital gains 100000 of the capital gains would be taxed at the current long-term capital gains tax rate.

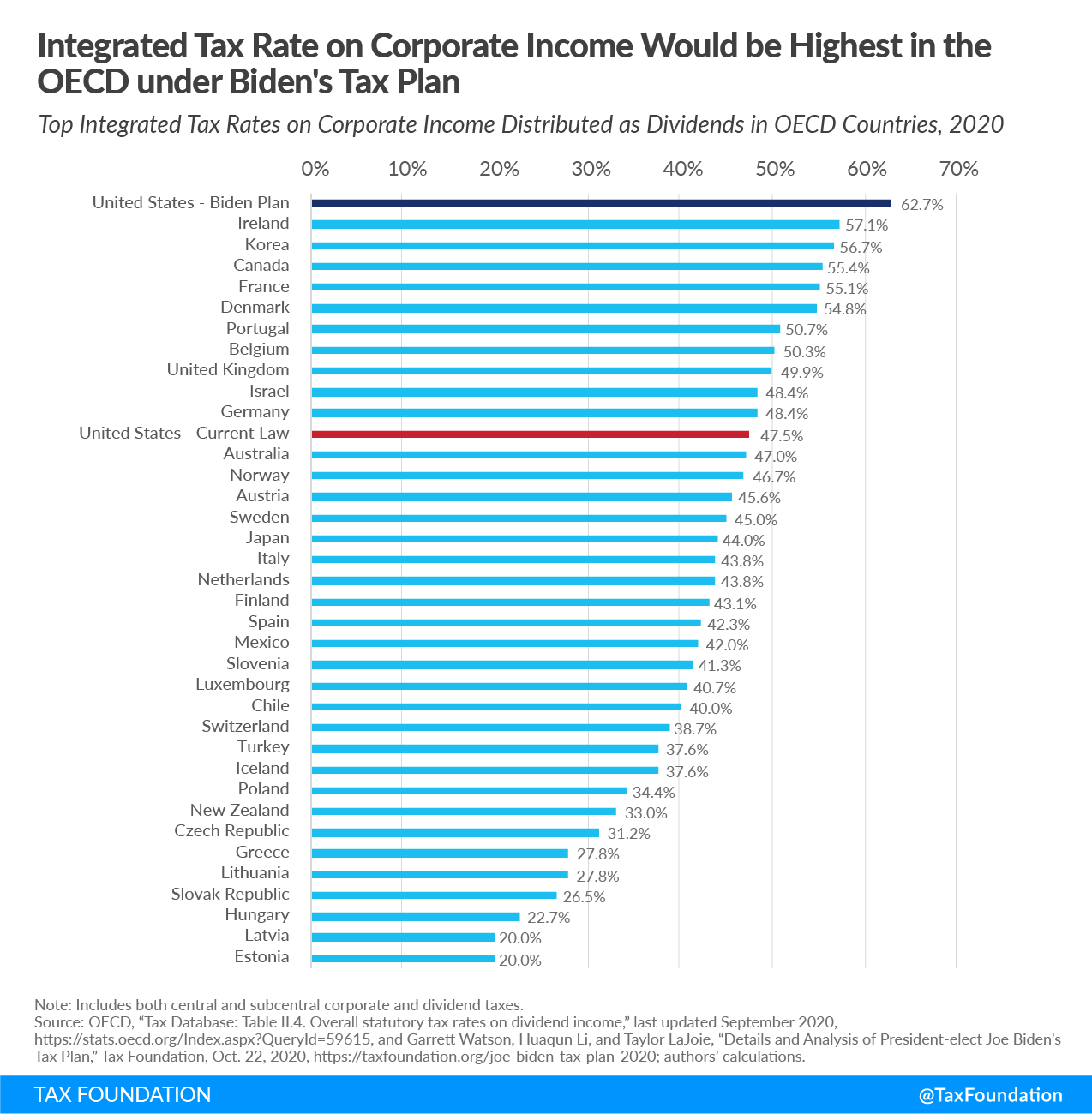

President Joe Biden proposed raising the top rate on long-term capital gains to 396 from 20. Weve got all the 2021 and 2022 capital gains. The expectation of this increase resulted in a 40 increase in.

Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed. Taxes and Asset Types - Investopedia 1 week ago Dec 21 2021 Capital gain is an increase in the value of a capital asset investment or real estate that gives it a higher worth. The plan also proposes changes to long-term capital gains tax rates nearly doubling the tax rate for high-income individuals by increasing it from 20 to 396.

Its time to increase taxes on capital gains. Instead of a 20 maximum tax rate long-term gains from the sale of collectibles can be hit with a capital gains tax as high. Implications for business owners.

A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee.

How Are Capital Gains Taxed Tax Policy Center

Congress Readies New Round Of Tax Increases

Tax Foundation On Twitter President Elect Joe Biden S Proposal To Increase The Corporate Tax Rate And To Tax Long Term Capital Gains And Qualified Dividends At Ordinary Income Tax Rates Would Increase The Top

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Analyzing Biden S New American Families Plan Tax Proposal

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Capital Gains Tax In The United States Wikipedia

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

A Probable Capital Gains Tax Rate Increase And The Potential In Opportunity Zones Caliber

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

How Are Dividends Taxed Overview 2021 Tax Rates Examples

California State Government Will Lose Big From Capital Gains Tax Increase Econlib

Capital Gains Tax Archives Tek2day

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Short Term Vs Long Term Capital Gains White Coat Investor

Capital Gains Tax In The United States Wikipedia

Capital Gains Taxes And S P 500 Returns Complete Strangers For Over 60 Years

:max_bytes(150000):strip_icc()/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png)